In case you hadn’t noticed, how and where many Americans work—the work environment—has changed significantly, especially since the 2020-2021 coronavirus pandemic era. Twenty years ago there were employees, most of whom worked within the IT industry at companies such as Cisco Systems, Google, IBM, or Microsoft, who were allowed to telecommute (as it was known) maybe once or twice a week. Co-workers who were based in different parts of the country (and sometimes on different continents) would periodically hold meetings and the proceedings were transmitted by satellite feed, which, while usually shaky, enabled teams to communicate and share information, make plans and agree on execution and desired outcomes.

Back in the day outsourcing arrived, a solution fueled by employee downsizing, a practice that in the aftermath of the 1987 stock market crash and recession became increasingly common. Outsourcing emerged as a strategy to address the need to replenish depleted labor talent pools without incurring costs associated with (re)hiring full-time employees—-better to avoid paying for health insurance, sick and vacation time and retirement funding. So, out with employees and in with the contractors.

In other words, while several alternative working options in America simmered beneath the surface for decades, it wasn’t until the 2020-2021 coronavirus pandemic that the doors blew off as business leaders recognized the necessity to immediately provide practical and effective solutions to keep their organizations alive and profitable. Enter the remote work force and a huge validation for Freelance professionals. Who knows how to do Work From Home better than you?

How we worked before has been transformed into what historians may one day label the most impactful labor movement since the Industrial Revolution. The transformation of how many people work, that is, the future of how we will work, is represented by Freelance professionals. In 2026, Freelance employment can no longer be called a mere trend—it is a phenomenon that impacts all 3.38 billion workers on planet Earth. The number of Freelance professionals continues to expand and justify the way we work now and will likely continue to work well into the 21st century.

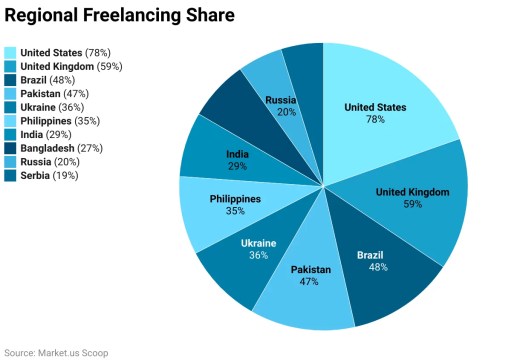

The influence of Freelance labor is demonstrated by its strong year-over-year growth in bellwether markets such as Britain, South Africa, India and the U.S. In 2026, the population of independent workers is predicted to reach 1.57 billion worldwide, with 83 million Freelancers engaged in the U.S.Freelancers make a substantial economic impact, contributing an estimated $1.27 trillion to the U.S. economy in 2024.

Most Freelance professionals work in the knowledge economy and perform services that require specialized expertise, education and training that’s obtained by earning undergraduate or advanced post-secondary school degrees and/or specialized certifications. From bookkeepers and accountants who ensure that clients’ financial statements are accurate and able to inform business decisions to special events photographers who memorialize the proceedings of Fortune 500 corporate meetings and other important events, the skills and ambition of independent workers have pushed the Freelance economy to unprecedented growth,

fundamentally reshaping the worldwide labor market and positioning the global business processing sector—finance and accounting, customer service, human resources, marketing and other B2B services– to generate revenue of $407.1 Billion (USD) in 2026.

The U.S. has the fastest-growing Freelance economy, with revenue increasing by 78% year-over-year 2023-2024 and a compound annual growth rate (CAGR) of 17% in 2025-2029. The global data-as-a-service giant Statista predicts that by 2027, 86.5 million U.S. workers will Freelance, accounting for 50.9% of the country’s total workforce.

Your inner optimist may interpret this forecast as an opportunity to grow your billable hours; your inner pessimist may see disturbing visions of increased competition in the Freelance hiring landscape. Why not be realistic and take a look at your organization to find where you would be wise to raise the level of your game and enable yourself to be more responsive to clients and prospects in ways that grow your client roster? Make lemonade out of the lemons.

In fact, Freelance professionals are optimistic about the future of Freelance work. Your confidence is fueled by increasing demand for specialized skills and a global pivot toward more flexible work arrangements. According to the Upwork Future of Work Index in April 2025, 82% of Freelancers say their work opportunities have grown since last year, versus just 63% of full-time employees. In that same report, 84% of Freelancers reported that they are excited by how the prospect of Artificial Intelligence tools will reshape their services, offerings and workflows.

Research indicates that Freelance work will continue in growth mode and the data has a high confidence level amongst the experts. You should be able to claim your share of the pie. If the intentions of corporate decision-makers can be taken to the bank (ha!) they support Freelance expertise. A January 2025 Upwork report found that 29% of executives believe that Freelance workers are essential to their business and 48% of CEOs plan to increase their hiring of Freelance workers over the next 12 months.

Still, there are worries that keep you awake at night. A November 2025 survey found that 66% of Freelancers feel that securing enough work is their primary challenge. Other major concerns included managing an irregular income, unpredictable work availability and non-paying clients.

Research also shows that Freelancing in 2026 won’t be all about finding projects; 2026 is shaping up to be about adapting to new skills, technologies and ways of working. Staying informed will help you to prepare and position yourself to keep up as the independent economy continues to grow. The Upwork Future of Work Index found that the most relevant Freelancing strategies to follow in 2026 will be to stay informed about global developments as you remain apprised of relevant shifts that occur in the U.S. B2B Freelance economy.

These are the signals every Freelance consulting specialist should pay attention to. For example, as automation becomes more common, skills that are uniquely human become more valuable. Negotiation, communication, empathy, storytelling, decision-making and leadership will help Freelancers stand out and facilitate building long-term client relationships. These soft skills are now seen as core strengths that technology cannot replace. The Future of Work Index shows that 87% of Freelancers prefer work that helps them improve their current skills or learn new skills, versus work that only allows them to use the skills and proficiency they already have.

Let’s finish up with some 2025 statistics that examine billable hours and revenue. I’m sure you know that Freelance earnings differ according to the services provided. Generally, the more technical the service, the higher the billable hour. High-demand services such as programming allow Freelancers in the field to bill at $70/hour. Artificial Intelligence and Machine Learning engineering are currently the highest-paid sectors among all Freelancing roles and expertise in one or the other niche allows you to command a billable of $50-$200 per hour. The number of computer and information research scientists is expected to grow by 26% by 2033. (Upwork)

- Full-time B2B Freelancers on average work approximately 43 hours per week

- Approximately 54% of Freelancers work five days a week

- On average, Freelancers earn $99,230 annually; however, the top earners have annual earnings of $200,000. Meanwhile, 25% of Freelancers earn $50,500 annually.

- The average hourly billable earned by U.S. Freelancers is $47.71, with a range of $132.21 to $14.90 per billable hour.

- The average Freelance programmer bills at $60-70/hour and generates annual revenue of about $120,000

- The average Freelance writer bills at $30-40/hour and generates annual revenue of about $42,000

- Online marketers typically earn $50/hour and generate $100,000 annual revenue

- Freelance graphic artists bill at $40-$45/hour but are known to receive enough billable hours to generate $90,000 in annual revenue

Thanks for reading,

Kim

Image: market.us