There are two inevitables in human existence and one of them is taxes. The good news is that in many cases, one can prepare and develop a strategy to minimize the impact of the tax burden. The ability to devise a good strategy requires current information and that is the topic today.

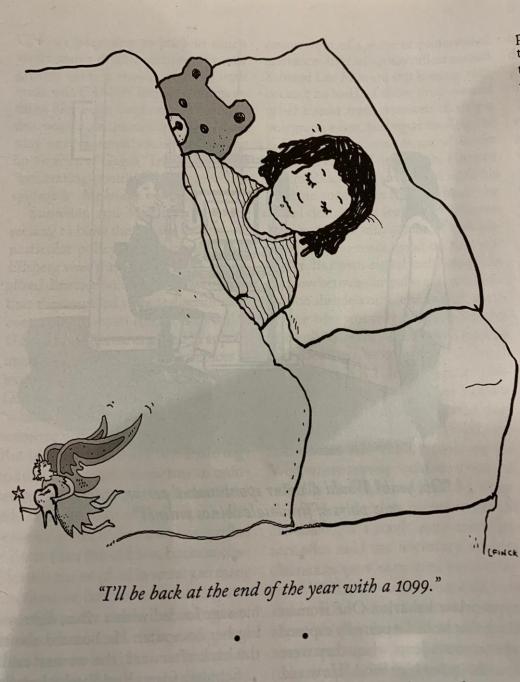

You’re probably aware of Federal legislation known as the One, Big, Beautiful Bill. You may not know that parts of OBBB have been revised and proposed changes to federal tax Form 1099-K were tabled and guidelines from previous years have been restored.

Officially titled the Payment Card and Third Party Network Transactions form,1099-K reports payments received from income generated by self-employed workers and paid to them by Third Party Settlement Organizations such as PayPal, Square, Stripe 2, or Venmo. Revenue received from transactions from online marketplaces, including Airbnb and eBay and also revenue derived from billable hours earned at Freelance B2B services platforms such as Fiverr and Upwork also trigger a 1099-K.

It’s important that Freelance professionals remain updated on federal and state tax legislation so that you can anticipate and prepare for your tax liability. If you’re able to choose your payment method—maybe you’re thinking of offering digital payment options for client invoices?—you would be wise to first assess the impact of that change to your finances. Giving clients additional payment options is now considered a competitive advantage and an aspect of customer service. But when you’d like to initiate payment flexibility, first discuss the matter with a tax accountant and let the tax filing implications, and also other financial advice, guide your invoice payment options.

Internal Revenue Service Form 1099-NEC

What will not change is IRS Form 1099-NEC (non-employee compensation). The form will be sent to self-employed workers, including Freelance professionals, other independent contractors and side-hustle specialists, who’ve been paid $600 or more in a given year. Your earnings most likely will not trigger a 1099-NEC if you billed the client less than under $600 in a calendar year, but you are still responsible for reporting all income whether or not you were sent a 1099-NEC. As a self-employed Freelance consultant, you are required to report self-employment income if your net earnings were $400 or more.

Internal Revenue Service Form 1099-K

As noted above, IRS Form 1099-K reports payments that Freelancers and other sellers of B2B or B2C goods and services received through Third Party Settlement Organizations such as PayPal, Square, Stripe 2, or Venmo for sales transactions between buyers and sellers have returned to the $20,000 billables and 200 transactions thresholds. Upwork and Fiverr will send 1099-K to Freelance workers whose billables equal or exceed $600 in a year, as noted above. Be advised that the proposed $2,500 (for 2025 earnings) and $600 (for 2026 earnings) thresholds are no longer in effect for 2025 and 2026.

As with 1099-NEC (and W-2), 1099-K statements must be sent to you, by email or hard copy, no later than January 31, 2026. If your clients pay you directly by credit, debit, or gift card, you’ll get a 1099-K from your payment card processor no matter how many payments you received or the total dollar amount of those payments.

Keep in mind that your state may have a lower reporting threshold for TPSOs, which could result in you receiving a Form 1099-K, even if your total gross payments and transactions did not exceed the federal $20,000 annual reporting threshold. Some states have their own rules for 1099-K reporting and your state threshold could be lower than the federal limit. While the IRS requires payment platforms to issue a 1099-K only if you have at least $20,000 in payments and 200 transactions for 2025, several states have set their reporting threshold at $600, regardless of the number of transactions.

Qualified Business Income (QBI) deduction

If your business entity is structured as a pass-through, you could be eligible for a 20% tax deduction by way of the IRS Section 199A Qualified Business Income (QBI) deduction. If you are an owner of a pass-through business entity, including S-corporations, Limited Liability Companies (LLC), Partnerships, including Limited Partnerships (LP) and Sole Proprietorships, can claim the QBI benefit whether or not they itemize deductions or take the standard deduction.

The QBI deduction allows eligible taxpayers to deduct up to 20 % of their QBI, plus 20 % of qualified real estate investment trust (REIT) dividends (not to be confused with income generated from rental property). Income earned through a C-corporation or W-2 wages are not eligible for the QBI Section 199A deduction. Eligible taxpayers can claim the deduction for tax years January 1, 2018 through December 31, 2025.

So who can do this? If taxable income (before the QBI deduction) is at or below the threshold amount—and thresholds are different for every year from 2018 – 2025, with the 2025 upper threshold at $197, 300 for single filing status and $394, 600 for married joint filing status—you’ll have access to the full deduction BUT the amount paid by an S-corp or a partnership that is treated as reasonable annual compensation for the taxpayer will not be eligible. To determine if your business may qualify for the QBI, click here to see this older, but useful, IRS form. Most of all, reach out to your tax accountant ASAP and verify your status.

Retirement Plan contribution deferral increase

Have you made a contribution to your retirement this year? If not, you have until December 31, 2025 to slide under the wire and save for your future. These retirement contributions come right off your income, lowering your tax bill and boosting your retirement financial readiness.

The Solo 401(k)—also known as the self-employed 401(k), individual 401(k), personal 401(k) or, to use the IRS’s preferred term, the one-participant 401—is known for its high contribution limits that enable Freelance consultants who have no employees for whom you provide benefits, to save for retirement. That includes Freelancers and gig workers who are Sole Proprietors, or structure their business entity as an LLC, S-corporations, C-corporations, or Partnership. If you have no employees, step right up to launch your preferred version of a single-person retirement fund.

- In 2025, the maximum contribution is $23,500 (wearing your entity’s employee hat), plus an additional 25% of compensation (wearing your entity’s employer hat). You can also contribute an additional $7,500 in catch-up contributions if you are age 50-59 or age 64 or older. Those between age 60 and 63 may contribute an additional $11,250 in catch-up contributions if the plan allows.

- In 2026, the maximum you can contribute is $24,500 as the entity employee plus an additional 25% of compensation as the entity employer, with additional catch-up contribution opportunities if you are 50 years or older.

If you file tax form Schedule C as a Sole Proprietor and have a SIMPLE IRA retirement plan, you are also treated as both employer and employee when calculating and reporting your plan contributions. Report both your salary reducing employee contributions and your employer contributions (non-elective or matching) for yourself on Part II – line 15 of Form 1040 Schedule 1, according to IRS info. You must deposit your salary reduction contributions within 30 days after the end of the tax year. For most people, this means salary reduction contributions for a given year must be made by January 30 of the following year. For most individuals, the annual contribution limit for a SIMPLE IRA is $16,500 in 2025 and $17,000 for 2026. Those who are age 50 years and older can also make an extra $3,500 catch-up contribution in 2025 and $4,000 for 2026 if their plan allows it.

Self‑Employment Tax & Deductions

You already know that Freelance workers must file IRS Form SE no later than April 15, 2026 and pay 15.3% total (12.4% Social Security + 2.9% Medicare) on the net amount of your self‑employment income—because you must fund your own Social Security and Medicare benefits. The good news is that you can deduct half of the self‑employment tax (the “employer equivalent”) from your adjusted gross income.

- Social Security Cap: On the first $176,100 of combined wages + self‑employment income in 2025.

- Additional Medicare Tax:

- 0.9% extra if income exceeds:

- $200K (single/Head of Household),

- $250K (married filing jointly),

- $125K (married filing separately).

Quarterly Estimated Taxes & Penalties

Because Freelancers file 1099-NEC and there is no withholding of earned income, you know that filing quarterly tax forms is a must-do if you expect to owe $1000 in federal tax, including self-employment tax; estimated tax payment must be paid with the quarterly filing. To avoid penalties, pay either 90% of 2025 tax or 100% of your 2024 earnings tax (or 110% of 2024 adjusted gross income if your earnings exceeded $150,000. Quarterly filing deadlines are April 15 (the annual filing), June 15, October 15 and January 15 (because 4Q earnings are reported in the new year).

In closing, I have a gift for those of you who will be 65 years old, or older, in 2025? if so, You’ll receive an extra $2,000 standard deduction (single filers) or $1,600 (joint filers).

Thanks for reading,

Kim

Image: The Tax Collector’s Office (1620-1640) Pieter Brueghel the Younger, courtesy of University of Southern California Fisher Museum of Art, Los Angeles