The Internal Revenue Service announced in December that it will delay by one year implementation of a new policy that will tax funds you receive by way of third-party payment processors. All entities using third-party payers to transfer funds derived from business activity must, at the close of the calendar year, report said payments on the appropriate IRS Form 1099 and send the documents to recipients of the payments, who will then include the amount of funds reported as part of annual income. The annual taxation threshold has been lowered to $600 for all types of 1099 income.

This new IRS policy was originally scheduled to take effect in 2023 and impact 2022 income, however, many who regularly receive funds through Venmo, Apple Pay, Samsung Pay and other peer2peer digital wallets apparently only recently learned that payments received would not only be reported on Form 1099-K but, alarmingly, will be taxed in the same fashion as 1099-NEC income.

Furthermore, because a significant number of personal financial transactions are also conducted on peer2peer platforms, users are concerned about both an unexpected tax bill and its accuracy. Can your electronic payment processor be trusted to recognize the difference between side hustle income and monies you received from friends to reimburse you for laying down your credit card when you all went out for drinks one night? Will the promised line of demarcation between business and personal fund transactions be consistently respected? Inquiring minds want to know.

Before the rule change, peer2peer payment services reported recipient income on Form 1099-K only when payments reached $20,000 and the number of transactions reached 200. If those conditions were met, the1099-K was required to be submitted to the IRS along with the tax return. The new policy has lowered 1099-K taxable income to $600 per year, aligned with 1099-NEC and 1099-MISC reporting income requirements. The number of payment transactions made will be irrelevant.

You’ve figured out by now that the tax law change will significantly increase the number of folks who will face a higher tax bill. Another loophole closes for the little guy! Still, the IRS has decided that the peer2 peer payments tax rule scheduled to expire on December 31, 2022 will instead remain in place until December 31, 2023 and the new ruling will apply to 2023 income.

Regardless of when the new IRS reporting rule takes effect, Freelancers and small business owners are not liking it. There is resentment that the tax change is specifically intended to crack down on suspected tax evasion within this cohort and others who toil in the gig economy, saddling you with more paperwork and headaches. The population that will be most affected often cannot afford to hire a tax attorney to defend themselves against suspected IRS or payment processor inaccuracies.

Venmo, which was bought out by PayPal in 2012, has been trying to prepare its customers for tax changes that could affect them. The company has emphasized that payments not specifically designated as being for goods or services will not be included on the 1099-K and that the company will not list individual transactions.

FYI, Venmo customers will be wise to familiarize yourselves with the differences between its business and personal accounts. Business users may be better off quittng that service, to avoid the additional fees charged, and instead track business transactions manually from the “friends” setting.

Finally, there is an intriguing twist to the story and a possible loophole has been revealed. Payment processor Zelle insists that the new IRS rule doesn’t apply to its bank2bank payment service, since its network doesn’t hold funds. The company is run by Early Warning Services LLC, which is jointly owned by seven banks (Bank of America, Truist, PNC, US Bancorp, JPMorgan Chase, Wells Fargo and Capital One). In fact, Zelle is included on users’ bank dashboards.

While Zelle offers a service similar to Cash App, Google Pay, PayPal and other peer2peer digital payment platforms, it was built as clearXchange, a peer2peer payment service created by and for its member banks. Zelle is an electronic network that manages automated clearinghouse (ACH) transactions.

According to Wendy Walker, chair of the Information Reporting Subgroup of the IRS Advisory Council, “ACH networks are not subject to 1099-K reporting.” She went on to say, in an email, that payments sent through its network “are not subject to this law” and that small business banking customers choose Zelle “because it makes it easier to complete digital payments where they bank, enabling easier bookkeeping and accounting by having the banking data at one source.” Ms. Walker seemed to infer that bank customers see a benefit in having money in their bank accounts that is not held by third parties.

OK. Of course, Congress could extend the law to include Zelle and similar “by banks, for banks” platforms. Stay tuned for updates.

Thanks for reading,

Kim

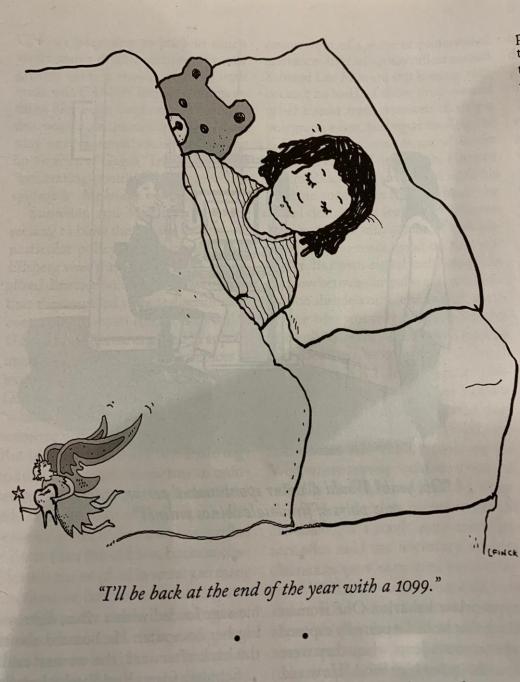

Image: © The New Yorker June 13, 2022. The End of the Year, Liana Finck, illustrator